Alpha extension: an innovative approach to core equities

Investors in US equity markets face a dual challenge: achieving sufficient net returns to meet long-term goals while also mitigating risk in a concentrated and volatile market. Traditional long-only active strategies have historically struggled to generate sufficient alpha after fees. As a result, many investors have shifted to passive index investing. While this approach provides efficient beta capture, it is difficult to generate excess returns and avoid broad market risks, including concentration and downside volatility. Other approaches, such as hedge fund strategies, aim to deliver higher excess returns and downside protection compared to traditional long-only equity funds. However, these strategies often come with high fees, leverage, risk and liquidity constraints, making them less accessible for many investors.

This has led to a demand for alternative equity strategies that aim to deliver higher returns than index funds while maintaining core market exposure and effective risk management. To address these investor goals, “alpha extension" strategies have emerged as a compelling solution, bridging the gap between traditional active and passive approaches and hedge fund portfolios. An alpha extension strategy offers the flexibility to capture more alpha potential from both long and short positions without significantly deviating from the risk parameters of traditional mandates.

What is an alpha extension strategy?

Alpha extension strategies enable investors to take both long and short positions while maintaining full market exposure (a beta of one). A common example is the 120/20 strategy, where 120% of the portfolio's assets are invested in long positions and 20% in short positions, resulting in a net market exposure of 100%.

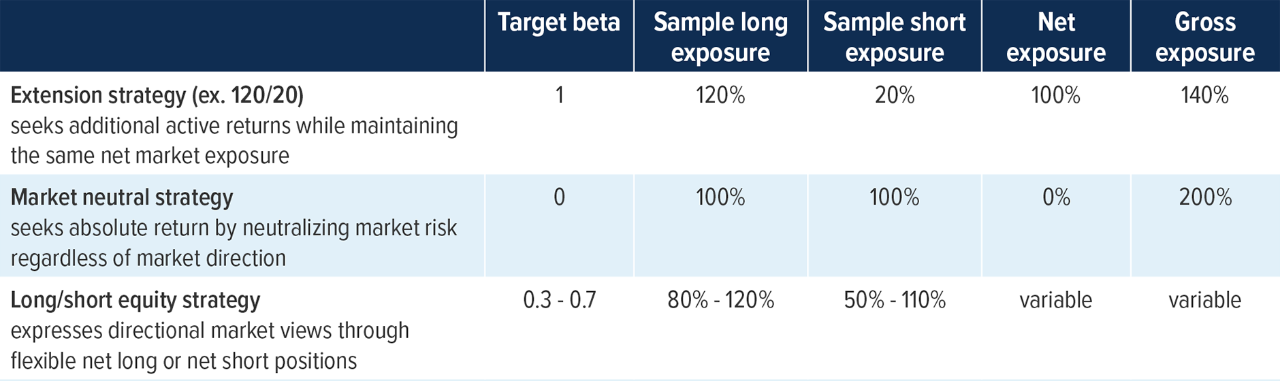

We aim to differentiate extension strategies from market-neutral and long/short equity strategies as they share similar characteristics but differ in certain key metrics such as net and gross exposure and beta exposure. The following are examples of these three short-enabled strategies.

Alpha extension strategy structure

An alpha extension strategy consists of three primary building blocks:

- Broad market exposure: managers gain exposure to the broad market while maintaining the flexibility to take active positions in liquid names across the large- and mid-cap spectrum.

- Short-selling skill: managers identify stocks expected to underperform and take short positions in these stocks by borrowing shares, with the expectation of repurchasing them later at a lower price.

- Additional long positions: the cash proceeds from short sales are used to purchase additional long positions in stocks that managers expect to outperform, enabling investment in high-conviction long positions.

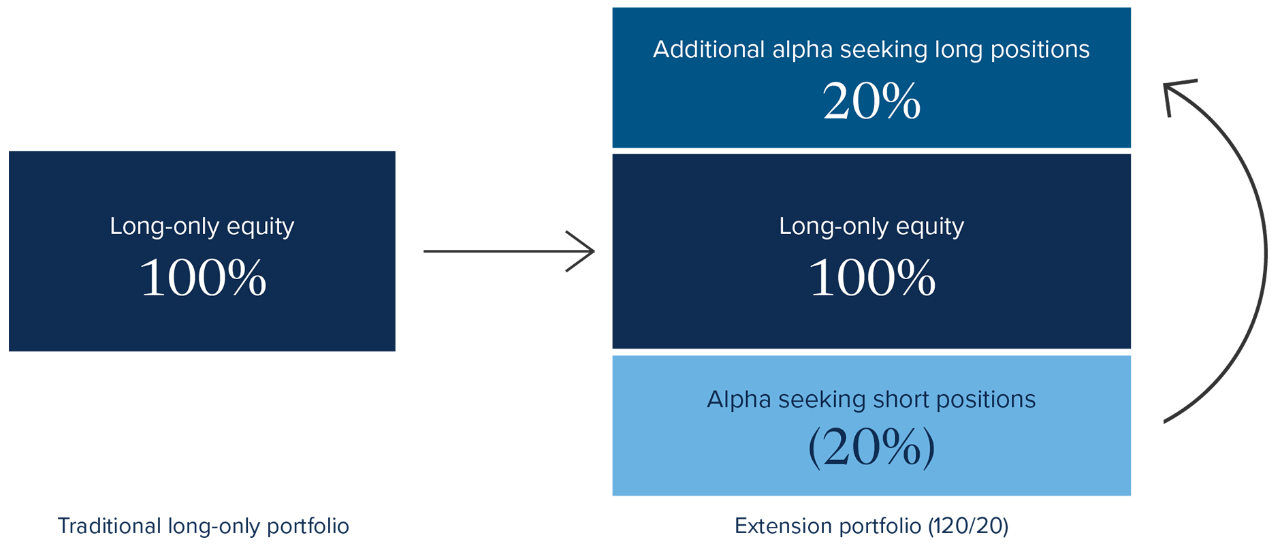

In the above 120/20 example, consider a manager starting with a traditional 100% long-equity portfolio. If they have $100 to invest, all $100 goes into long-only equities. In an alpha extension strategy, the manager still invests the entire $100 into long equities. In addition, they work with a broker to take short positions on stocks deemed overvalued, borrowing shares worth up to 20% of the portfolio, or $20 in this case. The manager sells these borrowed shares on the market and uses the proceeds to invest an additional $20 into alpha-seeking long-only equities.

When the time comes, the manager repurchases the borrowed shares, ideally at a lower price, and any remaining profit is reinvested into the fund. This results in a modestly leveraged portfolio with gross market exposure amplified to 140%, reflecting the total combined exposure of both long and short positions, and a net market exposure of 100%, similar to the original traditional core strategy. Other variations, such as 130/30 or 150/50, exist with different levels of leverage and shorting.

Portable alpha

A key advantage of extension strategies is the portable alpha component. The core of the portfolio is the 100% long overall market exposure. The additional long 20% and short 20% can be invested in areas of the market where the potential for alpha is greater (e.g. mid-cap stocks). This provides investors with a means to add additional alpha generation potential to their core equity portfolio without altering its overall market exposure or risk profile compared to the benchmark.

Figure 1: Traditional long-only vs. extension strategy exposure

How the Mackenzie GQE US Alpha Extension Fund "ports" alpha into a US equity portfolio

Why use an alpha extension strategy in a portfolio?

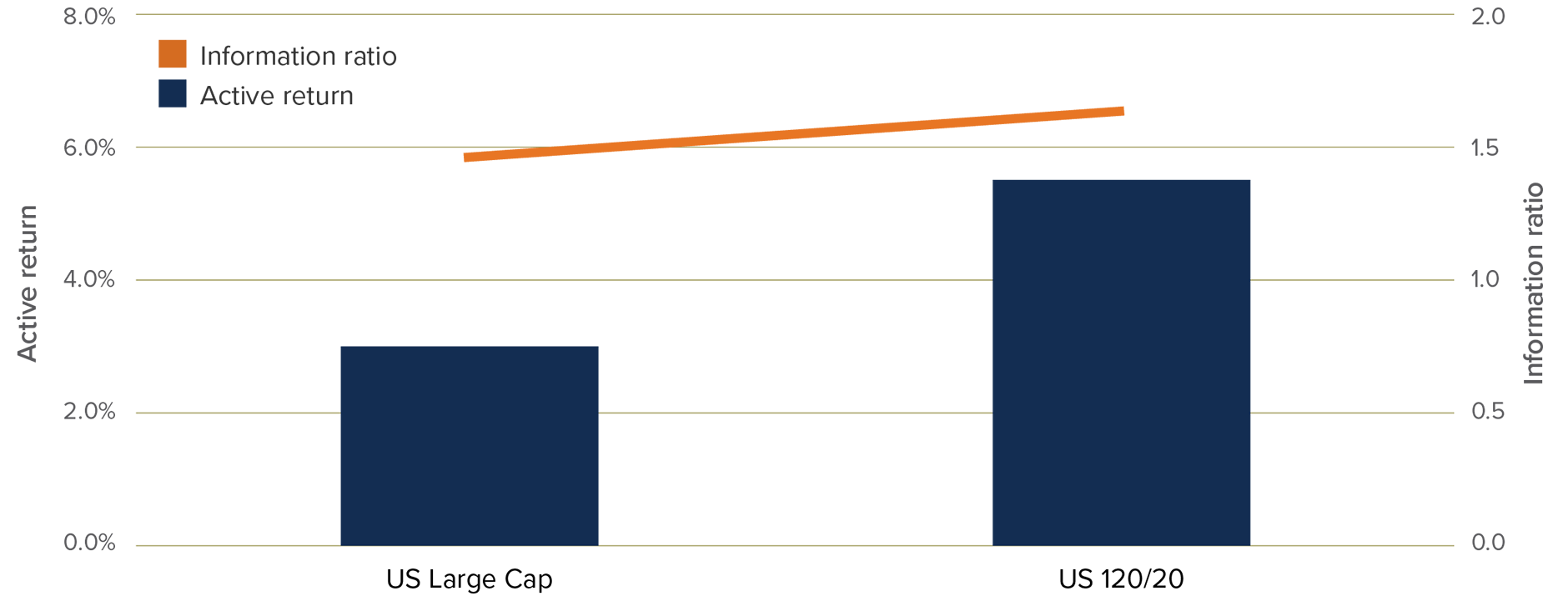

The objective of an alpha extension strategy is to enhance risk-adjusted return potential compared to a traditional long-only equity portfolio (see Figure 2), through well-researched stock-picking by relaxing common constraints to allow shorting. Shorting accomplishes two goals:

- Allows managers to express their views on securities expected to outperform as well as those expected to underperform, capitalizing on both upward and downward price movements.

- Further expands the opportunity set because the proceeds from the short sale can be invested in additional long exposure, creating a total long exposure of more than 100% of capital. Together, the shorts and added longs can increase potential alpha generation.

Figure 2: Extension portfolios deliver higher risk-adjusted returns compared to long-only portfolios

Sources: Hypothetical simulated portfolios that are based on Mackenzie GQE’s US investable universe over the past 10 years, from October 31, 2014, to October 31, 2024. For illustration purpose only.

Sources: Hypothetical simulated portfolios that are based on Mackenzie GQE’s US investable universe over the past 10 years, from October 31, 2014, to October 31, 2024. For illustration purpose only.

Alpha extension strategies are particularly effective in highly liquid markets, such as US large caps, where generating consistent alpha can be challenging. Investors disappointed with insufficient net excess returns of US long-only equities may underweight the S&P 500 Index in favour of smaller cap or non-US stocks, increasing volatility risks. Alternatively, they might abandon active alpha generation and shift to passive investing, which also carries similar volatility and concentration risks.

Alpha extension strategies are particularly well-suited to quantitative managers. Their systematic processes enable them to model and rank securities across a vast investment universe, often daily, to maximize opportunities. This approach provides a larger pool of potential candidates for both long and short positions.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This document may contain forward-looking information which reflect our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of April 22, 2025. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

Standard deviation provides a measure of the variability of returns that have occurred relative to the average return. The higher the standard deviation, the greater is the range of returns that has been experienced. Standard deviation is commonly used as a measure of risk.